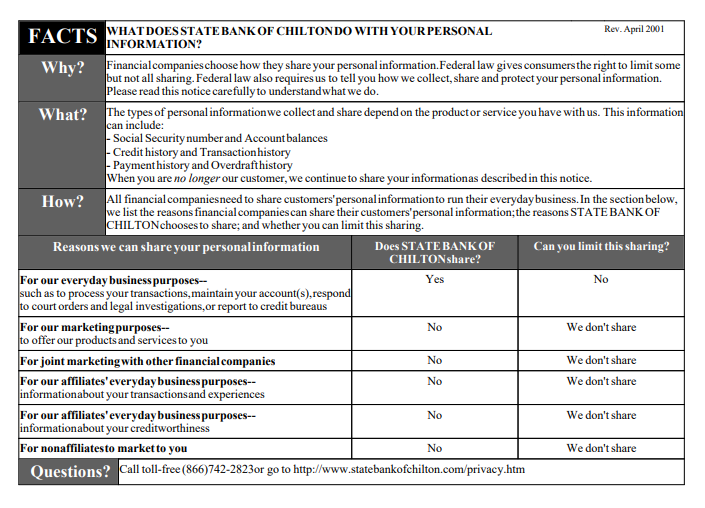

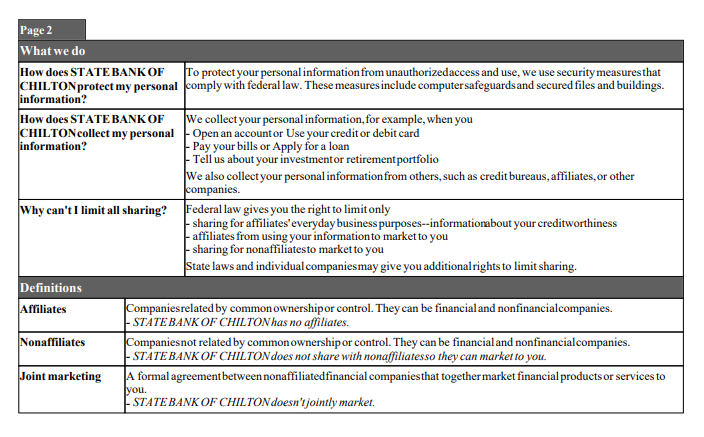

Privacy Policy

We recognize our customers' expectation that information provided to us by our customers or obtained by us about our customers will be safeguarded by us. This policy is intended to describe how we collect, maintain, disclose, and dispose of customer information. This policy may be amended from time to time at our discretion. If you have any questions please contact us.